HILO — West Hawaii’s three council districts, home to a third of the island’s approximately 198,000 people, continues to be the county government’s cash cow, accounting for almost 70 percent of property tax revenues under rate hikes planned by Mayor Harry Kim.

HILO — West Hawaii’s three council districts, home to a third of the island’s approximately 198,000 people, continues to be the county government’s cash cow, accounting for almost 70 percent of property tax revenues under rate hikes planned by Mayor Harry Kim.

That’s according to a West Hawaii Today analysis applying Kim’s proposed tax rates to certified property values released late last month by the county Department of Finance.

Kim is proposing 6.5 percent across-the-board tax rate hikes, with the exception of the affordable rental class, which will stay the same. Property tax revenues from properties across the island, plus penalties and interest, will go up by $21.5 million to $300.1 million, primarily because of the increase in tax rates.

Property in the homeowner class valued at the island average of $300,000 with no other exemptions would see its annual tax increase $120, from $1,845 to $1,965. Property in the residential class, which includes second and third homes and rentals, valued at the same amount, would see its tax increase $195 from $3,015 to $3,210.

This will be the third time property taxes have been raised since 2010.

Most of those responding to a crowd-sourced Facebook question posted Thursday seemed to think their property taxes are more than reasonable, and many didn’t seem opposed to a rate increase.

“Our property taxes are currently ridiculously low,” said Donald Anderson, who lives in Hilo’s District 2.

Anderson and his wife have lived here full time since 2004, after purchasing their home and renting it out in 2001. Their taxes decreased markedly once they began taking the homeowner’s exemption, he said. The couple also pays lower taxes because they’re older than 70.

Bobby Jean Leithead Todd, a former County Councilwoman who retired after a career in county government, says her taxes have dropped significantly since she bought her house, also in District 2, in 1989.

“If the $709 (in 1989 taxes) were adjusted for the cost of living, inflation, my tax should be a bit above $1,400 in 2017,” Leithead Todd said. “Instead, even with the proposed tax rate hike, I would still pay less than I paid in 1989 even though my house is worth three times what it was in 1989.”

People on low or fixed incomes will feel the difference, other residents said.

“I lived here all my life so I have no other place to compare,” said Josephine Keliipio, a retiree who works part-time. “I have a residence in Kona and an acreage in Puna and any increase will affect me.”

Kim said many people who have moved to the island from somewhere else see the property taxes as a bargain.

“I’m pretty proud of our county government for what we get in taxes and what services are provided in comparison,” Kim said Friday. “There’s people out there that know they’re getting their money’s worth.”

Some don’t see the increase as fair, saying an increase in the minimum tax rate in particular will hit the poorest the hardest. About 35,689 property owners paid the minimum property tax last year, with some paying $100 and others as little as $25 annually. That’s out of 140,858 taxable properties.

Those paying $100 would see their rate double to $200 under the new plan. Properties with a market value of $500 or less would no longer pay the $25 minimum, but would have no tax.

Kevin Hopkins, a professor at University of Hawaii at Hilo’s College of Agriculture, Forestry and Natural Resource Management, said the current tax system needs a complete overhaul, because wealthy landowners and land bankers end up paying lower taxes per acre than those paying the minimum for their small lots.

That’s from a combination of agriculture exemptions and the fact that the value of the land assessed for tax purposes is so much lower than market value, he said.

“It’s not the poor people who are’nt paying their fair share,” Hopkins said. ”It’s the rich people who aren’t paying their fair share.”

Kim notes that the minimum tax hasn’t been raised in 15 years, and he added it’s based on a sliding scale to ensure fairness. He said he and administration officials went back over the various scenarios over the past couple of days and decided the current proposal is the most fair.

“Of all the taxes I have to raise, this one’s the most difficult,” he said.

Kim said taxes have to be raised to prevent furloughs or layoffs because of costs outside the county’s control. Employee raises negotiated at the state level and retirement costs came in higher than planned. The county is also taking a $2 million hit in its share of the transient accommodations tax on short-term lodging because of inaction by the state Legislature.

The proposed tax rates for the operating budget, Bill 11, will be the focus of a public hearing at 5 p.m. Tuesday. The council will then undertake a line-by-line amendment of the budget during first reading beginning at 9 a.m. Thursday. Both meetings are scheduled for Hilo council chambers, with testimony also taken by videoconference from the West Hawaii Civic Center, the Naalehu state office building, Pahoa council office and the old Kohala courthouse.

Kim and his Cabinet also plan to talk about the budget at a meeting of the West Hawaii Forums group from 6-8 p.m. May 25 at the West Hawaii Civic Center.

Tax districts broken down

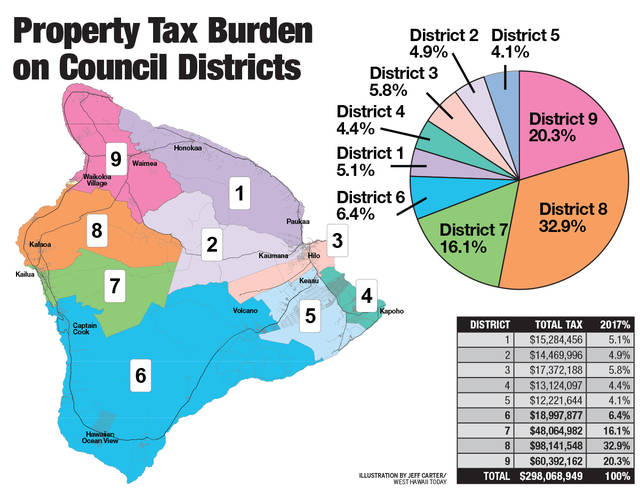

The newspaper’s analysis shows North Kona District 8 with the highest property tax burden, carrying a full third of all property taxes paid on the island. That’s followed by Kohala District 9, with 20 percent and Kona District 7 with 17 percent.

West Hawaii’s District 7, 8 and 9, the only districts with a double-digit tax burden, together account for 69.3 percent of all property taxes paid on the island.

At the other end of the spectrum is Puna District 5, with 4 percent of the property taxes on the island. Hamakua District 1, Hilo District 2 and Puna District 4 each contribute 5 percent.

The newspaper did the analysis by aggregating by council district all net property assessments and applying the proposed tax rates for each of the nine property classes within each district.

The County Council has until June 20 to establish tax rates. The budget year starts July 1.

The analysis found that North Kona’s District 8 will pay about $98.1 million, Kohala’s District 9 will pay $60.4 million and Kona’s District 7 will pay $48.1 million of the approximately $298.1 million tax base under the proposed rates.

In contrast, Puna’s District 5 will pay the lowest, $12.2 million, Puna’s District 4 will pay $13.1 million, Hilo’s District 2 will pay $14.5 million, Hamakua’s District 1 will pay $15.3 million, Hilo’s District 3 will pay $17.4 million and South Kona/Ka‘u’s District 6 will pay $19 million.

District 5 Councilwoman Jennifer Ruggles said her district’s low tax burden is no reason it should be shorted county services. She’s sponsored a resolution pushing the county to acknowledge it has historically discriminated against the low-income and Native Hawaiian populations of Puna while using the districts’ tax money to subsidize higher-income neighborhoods elsewhere on the island.

Besides, she told the newspaper Friday, tax revenues in Puna are just slightly behind those of Hilo, while Hilo’s districts have received a disproportionate benefit in terms of capital improvement projects.

“The difference (in tax revenue) between Hilo and Puna is minuscule,” Ruggles said, adding, “How is it pono to give less to those with less and more to those with more?”

Property assessment notices were sent out in late March and property owners had only until April 10 to file an appeal. Appeals are heard by the Tax Board of Review, a five-member board appointed by the mayor and confirmed by the council.

In addition to the value of the property itself — West Hawaii properties in general have a higher assessed value — factors that play into determining tax values include various county exemptions and new construction that raises property value.

Assessed values for properties in the homeowner class and affordable rental class, not including any improvements, are capped at 3 percent annually until the property changes hands. So districts with a lot of longtime homeowners rather than those who have second homes in Hawaii would see less of an increase in value.

Property exemptions for homeowners also play a role. Homeowners receive an exemption of $40,000. Homeowners aged 60 to 69 receive an $80,000 exemption and those 70 and over receive a $100,000 exemption. Additional exemptions apply for the disabled and disabled veterans.

The proposed budget also gives a break to the increasing number of elders. The current $100,000 property assessment reduction for those 70 and over will be increased to $110,000 for those between 75 and 80 and $120,000 for those 80 and older.

North Kona’s District 8 has a high concentration of hotels and resorts as well as second homes. Those categories not only pay higher tax rates, but they also don’t qualify for exemptions that lower the property values.

While County Council members look out for their own districts, they also take a countywide approach, said District 8 Councilwoman Karen Eoff.

“Although North Kona does pay the highest percent of the overall property tax income, we should always look at the island as a whole when allocating resources,” Eoff said. “Over the last several years, we have seen many infrastructure improvements in Kona. I believe that by working collaboratively with the community and the administration, legislators are able to help prioritize those projects that will have a positive impact in their respective districts.”

DISTRICT TOTAL TAX PERCENT

DISTRICT 1 $15,284,456 5.1%

DISTRICT 2 $14,469,996 4.9%

DISTRICT 3 $17,372,188 5.8%

DISTRICT 4 $13,124,097 4.4%

DISTRICT 5 $12,221,644 4.1%

DISTRICT 6 $18,997,877 6.4%

DISTRICT 7 $48,064,982 16.1%

DISTRICT 8 $98,141,548 32.9%

DISTRICT 9 $60,392,162 20.3%

TOTAL $298,068,949 100.00%

DOLLARS OF TAX PER 1,000 VALUE

TAX CLASS CURRENT RATE PROPOSED RATE

AFFORDABLE RENTAL $6.15 $6.15

RESIDENTIAL $10.05 $10.70

APARTMENT $10.85 $11.55

COMMERCIAL $10.05 $10.70

INDUSTRIAL $10.05 $10.70

AGRICULTURAL $9.25 $9.85

CONSERVATION $10.85 $11.55

HOTEL & RESORT $10.85 $11.55

HOMEOWNER $6.15 $6.55